Year of the Li-ion: Time to scale up

You can hear it … almost distinctly now… the footfall of the battery era. It's here to stay one would like to believe, for a lot rests on it; the present and most definitely the future. This year, the overwhelming response to the PLI schemes has proved that India's time to step up as a manufacturer-supplier of batteries and parts has begun. All efforts now should be towards scaling up – the hard work, the investments, the ventures, and most importantly the belief.

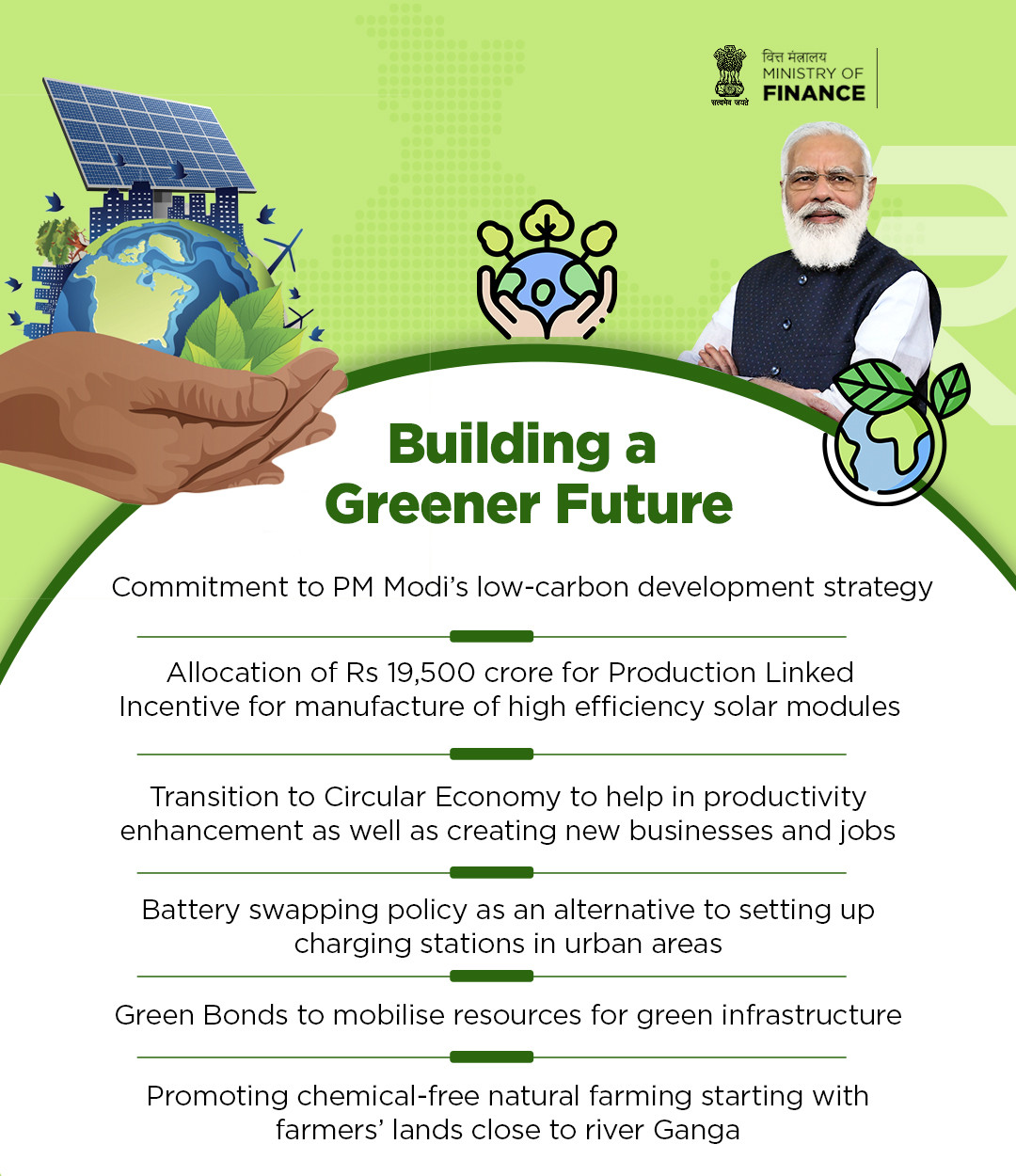

For the energy storage industry, the air is euphoric. There is a lot to be excited about: favourable policies, inviting sops, encouraging growth in EV sales, promising productive alliances, etc. The government push for battery cell manufacturing in India on a larger scale had begun a while ago, but the proverbial ball started rolling with the introduction of the PLI schemes for ACC and electric vehicles. This year's budget furthered the aspirations by announcing allocations for the growth of RE, grid integration, e-mobility and charging, among other things. This has brought to fore the important role energy storage will play in the immediate future.

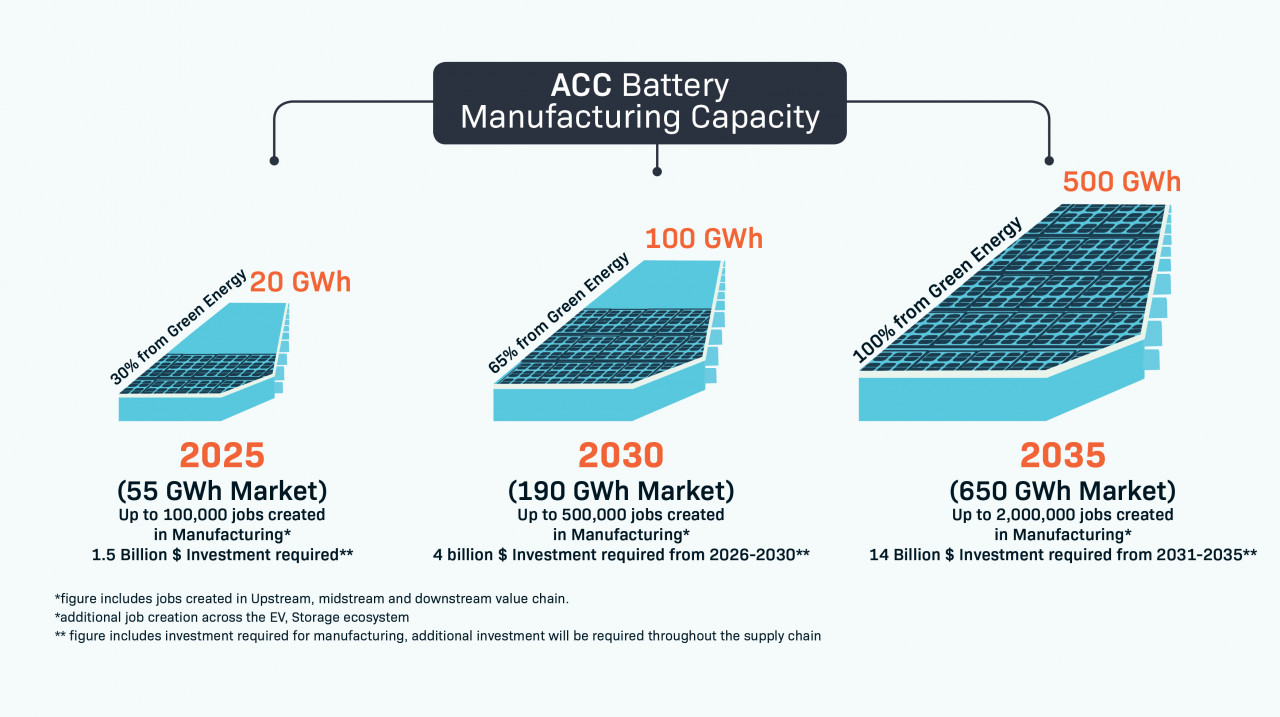

The PLI schemes are intended to promote local manufacturing of battery cells and auto components through suitable policies and subsidies. Widely welcomed by industry leaders, the schemes are considered a concrete step towards achieving self-reliance, with an objective to achieve manufacturing capacity of 50GWh of ACC and 5GWh of 'niche' ACC, with an outlay of ₹18,000 crore; and to enhance manufacturing capabilities of Advanced Automotive Products (ATT), with an outlay of ₹25,938 crore.

It is expected that the incentives would encourage the industry to promote fresh investments in indigenous supply chains and help secure localization for battery and EV manufacturing in the country. Having said that, there has also been speculation that the high qualification criteria might not attract heavy endorsement of the scheme.

"Technology and supply chains will further mature, the cost will come down, incentives are in place, but what will control business growth most of all is the consumer confidence and mindset, and the speed at which the average consumer is willing to take the bet on e-mobility and follow its pioneering peers."

While last year many biggies took a wait and watch stance, early this year the government received totally 10 bids with capacity of 130 GWh -- over twice the manufacturing capacity to be awarded – under the 'National Programme on Advanced Chemistry Cell (ACC) Battery Storage'. An overwhelming response was also received for the PLI scheme for the automobile and auto components sector, with almost 95 companies approved from around 115 applications received.

The dream, long conceived and dedicatedly pursued by believers, that India's time to enter the global market as a supplier has begun its run towards realization. Yes, the stage is set but a lot has to be achieved yet: setting up foundations of the giga factories, starting construction, and possibly go live with the pilot lines next year. It is desired that by 2024 production will start.

Dr. Rahul Walawalkar, President – India Energy Storage Alliance(IESA) feels that the next couple of years will be critical for India; the focus needs to be on technology partnerships, skill development, and capacity building to support Giga factories as well as the complete supply chain. To enable such end-to-end development of the sector, IESA launched India Battery Supply Chain Council in December 2021. The Alliance has also set a roadmap where India is expected to have at least 25 GWh of manufacturing capabilities by 2025, 70+ GWh by 2027, and cross 100 GWh by 2030.

Dr. Walawalkar is excited about the prospects of the ACC battery manufacturing PLI: "India has taken the first step to realize our dream of becoming a global hub for R&D and manufacturing of advanced energy storage technologies. It is great to see that not just the four ACC PLI winners, but additional 5+ groups are planning to go ahead with investments in giga factories in India in next 2-3 years."

Research reports deduce that India will need a minimum 10 GWh of cells by 2022 and 50 GWh by 2025. This expectation means there will be a rise in demand for EVs in the coming years, and this is what is eagerly anticipated. The general response is that the government mandates might be the missing link between EVs and mass adoption. In that aspect the subsidies announced through PLI could well give a boost to local manufacturing and intensify domestic demand across India.

Awadhesh Jha, Executive Director - Fortum Charge & Drive India, feels that the implementation of PLI schemes will impart additional acceleration to the government's increasing support for the adoption of EVs. He said: "With the recent geopolitical development taking place in Europe, and renewed enthusiasm towards adoption of EV shown globally in general, and in Europe in particular, in the year 2021, and Indian consumers showing leap of faith in adopting EV (record sale of EV across segment is testimony to the same), I do not doubt to accept that the year 2022 would be directional for e-mobility."

Does BaaS fit in?

This year the budget has taken energy transition and climate action as focal points in its low-carbon strategy; one of the government's action plans is to push battery-as-a-service or BaaS, as an alternative to setting up charging station in urban areas.

Under the BaaS model, batteries can be leased out or swapped, bringing down the upfront cost of an EV.Apart from reduced battery price, battery swapping can also help address charging time and range issues. With swapping, there will also be less stress on charging infrastructure. This model promises to bring great relief to the end user, but is still in its early stages, where standardization of batteries will prove to be the main area of concern.

Battery swapping has the potential to revolutionize the EV market going forward; at the same time, there are immediate challenges that hinder the concept.

- -The 18 percent GST that will be charged by swapping service providers, against the incentivized 5 percent GST applied on purchase of an EV. Moreover, FAME-II incentives are not offered to vehicles sold with BaaS or swap station operators. IESA, in its recommendations to the government has asked that a reduction in GST rates for batteries for EVs to 5 percent should be considered; this will ensure smooth transition towards EVs without disturbing the cost factor.

- Manufacturers preferring to produce proprietary battery and charging systems, might make it difficult to set up an interoperable battery swap infrastructure. As the swapping one-size-fits-all model will require standardization, without which EV safety will a major concern

Mr. Louis believes that BaaS is a great solution for specific market segments, and will therefore capture part of the market. He points out: "Standardization is important for BaaS to be successful, but the government needs to be careful that the creation of such standards should not hamper innovation or benefit specific organizations." He is of the opinion that the government should not focus on technical details, and rely on the industry to take charge of this.

Mr. Jha too agrees on BaaS being a great concept, with its space in the e-mobility sector. "Battery swapping, in my view, is a very promising solution for 3W and 2W delivery segment. What is needed is standardization of form factor and chemistry, so that an operator who is absorbing more than 50 percent cost of the EV should have larger use case to get desired return on investment. I expect the Battery Swapping Policy to bring that clarity."

About the driving factors for growth in the EV charging services business, he said: "What awaits our sector in terms of business is the implementation of new policies in the segment, increased investments, and the country's journey towards net-zero carbon emissions by 2070. Another important factor is the public and private sector's collaborative action. Public charging infrastructure is going to play an important role in the next two years to give the EV users the confidence of driving with focus without any 'range anxiety'."

The most exciting offering of the budget, perhaps, would be the accordance of 'infrastructure status' to energy storage systems, including grid scaling battery system, to financially complement the clean energy policy and projects. This places energy storage in the prime position, the benefits of which can be translated to grid and storage, RE integration, and e-mobility.

So, with the production advantages in place, the foundation of a value chain beginning to take shape, and global e-mobility already in momentum, India is poised at get-go. Every year has brought with it a pivotal moment, we have seen launches, spurts in demand, green energy commitments at global forums, key policy decisions to fulfil those commitments… This year, it's time to pull back the sleeves and get to the hard work. It has become imperative that the manufacturer, the service provider, and even the buyer come together in support of the green energy transition. There needs to be a lot of convincing, believing and keeping the faith.