India’s energy transition: The way to net-zero

About 140 countries covering 90 percent of global emissions; 410 publicly-traded companies and 450 financial institutions representing $130 trillion in assets have announced net-zero targets. Vibhuti Garg, Energy Economist – Lead India, The Institute for Energy Economics and Financial Analysis (IEEFA) feels this year could well be called the year of net-zero, and writes about how the push for decarbonization will require huge investment.

At COP26, Prime Minister Narendra Modi ratcheted up India's clean energy targets, pledging to cut emissions to net-zero by 2070; in addition to increasing non-fossil capacity to 500 GW, meeting 50 percent of energy requirements from renewable sources, reducing emissions by 1 billion tons, and reducing the emission intensity of the economy by 45 percent from 2005 levels by 2030.

While Indian companies have been slow to join the race to net zero, they are starting to get their act together: 14 have committed to net-zero targets, 29 have announced science-based targets and 69 have committed to taking climate action.

Some of India's biggest companies, such as Tata, Reliance, Mahindra, ITC, Adani, and Dalmia Cement have made net-zero announcements. Various government corporations like Indian Railways and Chhattisgarh Health Department have also committed to achieving net-zero carbon emissions by 2030 and 2050 respectively.

Finance will play a key role in helping countries achieve their net-zero targets. As per McKinsey's report, global capital spending on physical assets for energy and land-use systems in the net-zero transition between 2021 and 2050 would amount to about $275 trillion, or $9.2 trillion per year on average – an annual increase of as much as $3.5 trillion. Moreover, an extra $1 trillion, in addition to today's annual spending, would need to be reallocated from high-emission to low-emission assets.

The report also highlighted that the exposed geographies, including in sub-Saharan Africa and India, would need to invest 1.5 times more than advanced economies as a share of GDP today to support economic development, and build low-carbon infrastructure. In a 'Net-Zero 2050' scenario, India's capital requirements would be 11 percent of GDP, compared with the global average of about 7.5 percent of GDP.

While a detailed sectoral study on India's net-zero emissions is yet to be done, the IEA India Energy Outlook 2021 presented various scenarios, including the Sustainable Development Scenario (SDS), wherein India will witness an early peak and rapid subsequent decline in emissions, consistent with a longer‐term drive to net zero. This scenario illustrates the net-zero roadmap for India, but the IEA has shifted the global goal post from 2070 to 2050. This implies that transition to renewable energy and firming capacity will have to accelerate relative to that mapped out in the SDS scenario.

If we look at the short-term target of 2030, the expected annual investment for deployment of renewable energy, battery storage, electric vehicles, and network expansion and modernization of the grid is $110 billion in the SDS for India. This means India would need an investment of $1.1 trillion between 2021-2030. This is about three times the current annual investment ($40 billion) in these sectors. However, to achieve the net-zero emissions roadmap, the corresponding investment requirement will be much higher than the SDS.

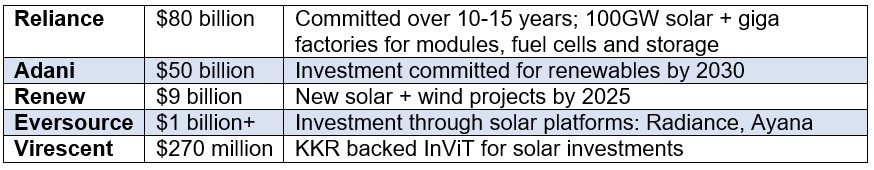

The year 2021 saw some big-ticket renewable energy investments by large companies.

India needs to exploit the rapidly growing pool of global capital from sovereign wealth funds, global pension, private equity, and infrastructure funds, as well as global utilities plus oil and gas majors pivoting to clean energy but struggling to find infrastructure projects at scale.

Private capital, institutional investors, economic, social, and governance (ESG) financing, green bonds, sustainability-linked bonds, infrastructure investment funds, etc. will play a key role in helping achieve ambitious climate targets. Finance Minister Nirmala Sitharaman in her Budget 2022 speech announced that the government will issue sovereign green bonds for projects that will help reduce the carbon intensity of the economy, enabling access to large pools of money for the energy transition.

Voluntary carbon markets, which hit a record $1 billion in traded volumes in 2021, are also gaining momentum and have the potential to be a good platform for Indian companies to trade their carbon credits. Carbon prices are booming, rising 900 percent during 2021, as per Platts CEC.

The roadmap to net-zero would involve huge investment, requiring decarbonization of not only the power sector but industries, buildings, transport, agriculture, forestry, and other land use. It is a long road ahead. The task is daunting, but with the increasing cost-competitiveness of clean energy solutions like battery storage, green hydrogen, and off-shore wind, there is light at the end of the tunnel.